Council delays decision on fossil fuel investment amid mounting pressure

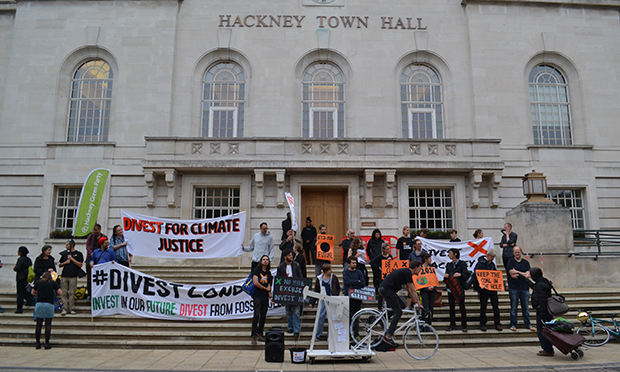

Turning up the heat: Divest Hackney campaigners protesting yesterday. Photograph: Hackney Citizen

Hackney Council will not make a decision on whether to dump its controversial investment in fossil fuels until next year, despite vocal opposition from residents and campaigners.

The council’s pensions committee met last night, following an eye-catching protest by Divest Hackney campaigners on the steps of the Town Hall.

The climate campaigners want the council to ditch its £42 million investments in coal, gas and crude oil extraction.

They say the stocks and shares, amounting to around six per cent of total investments by the council’s pension fund, are unethical and make for bad financial planning because of limitations that would make fossil fuel extraction harder in future.

But in a statement, Cllr Robert Chapman, Chair of Hackney Council’s Pensions Committee, said the move to greener investments “won’t be immediate”.

“There are other significant responsibilities to those that have a pension, to Council tax payers, as well as considerable financial risks that need to be taken into account,” he said.

Cllr Chapman confirmed that the council was working on a new investment strategy that would be in place by early 2017.

The new strategy will reportedly address the issue of fossil fuel investment as well as taking into consideration other factors such as new government regulations that require investments to be shared across eight central pools.

“We cannot make significant changes to how the fund is invested now, as it would result in significant costs which we would then have to pay twice as we move into the pooled funding arrangements,” said Cllr Roberts.

“This would be irresponsible towards those whose pensions it manages as well as other stakeholders including local council tax payers.

“We are committed to taking a very active approach to carbon risk and helping to address fossil fuel concerns, but we also have a duty to ensure investment risks and returns are balanced, with the overriding requirement to ensure that the fund can pay the benefits due to its pensioners.”

Sarah Latto is a volunteer with Divest Hackney who was at the protest. She said: “It’s a no brainer. In a few years no one is going to be investing in fossil fuels. It’s financially prudent to divest now.”

Haringey is among the councils that have already said they will not continue to invest in fossil fuels.

The pension fund is managed by eight different fund managers: UBS, Lazard, Wellington, RBC, BMO, GMO, Columbia Threadneedle and Invesco.

The council says total fees paid to the fund managers varies “according to performance”. In the last financial year total investment manager funds amounted to £3.844million – around 0.33 per cent of the value of the assets being managed.

Update at 11.12am on 21 September to include further details on the pension fund and how it is managed.

Town Hall criers: Banners were unfurled to highlight the climate change crisis