Top tips for saving money from Hackney CAB

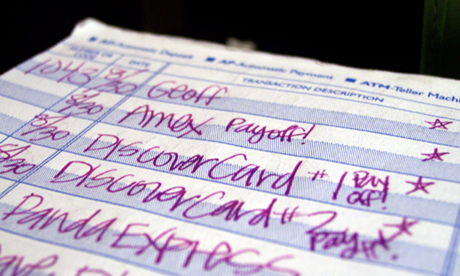

Hackney Citizens Advice Bureau can help you improve your money management. Photograph: Lemon Jenny

With the current economic climate and recent figures suggesting that the average British household owes £5360 in loans (excluding mortgages), overdrafts and credit cards, now is a good time to try to get your finances in order.

Here are some tips from Hackney Citizens Advice Bureau:

Many people are struggling to make ends meet and while it may not be possible to easily increase your income, you may be able cut your day-to-day expenses and reduce some non-essential expenditure.

First of all, draw up an income and expenditure sheet or personal budget. You can get help with this at www.nationaldebtline.co.uk and www.moneyadviceservice.org.uk. This will list your monthly income and outgoings.

Is there anything you can do without? Do you need to buy a paper every morning or a coffee on the way to work?

Are there any regular expenses that you can reduce? You could consider switching energy suppliers, change your insurers, switch your broadband provider, change your mobile deal and shop around for a cheaper mortgage.

Consumer Focus lists approved online price comparison websites at www.consumerfocus.org.uk

You may be able to make one-off savings by using vouchers and discounts from websites like www.moneysavingexpert.com or www.discountvouchers.org.

Don’t borrow more to pay off existing debts – some payday loans work out as charging the equivalent of over 4000% in annual interest. It’s far better to seek advice and to try to reduce existing expenditure than to get further into debt.

If you do need further credit, credit unions may provide cheaper forms of credit. Contact London Community Credit Union at www.londoncu.co.uk (tel: 020 7729 9218) for more information.

If you still have problems paying your bills, you must prioritise. Paying the rent or mortgage is more important than paying off your credit card. If you are having problems contact your creditors and seek advice.

There are many organisations that can help and in many cases creditors will agree to freeze interest and charges and accept reduced repayments. National Debtline has a helpline 0808 808 4000 or you can visit www.adviceguide.org.uk for information and factsheets. Consumer Credit Counselling Service www.cccs.org.uk (tel: 0800 138 1111) and Payplan www.payplan.com (tel: 0800 716239) provide free budgeting and debt advice.

You can also access confidential advice and information on problems with debt at:

Hackney Citizens Advice Bureau

300 Mare Street

Hackney

E8 1HE.

Tel: 020 8525 6350.

This article was written by Andrew Skipper, financial capability trainer at Hackney Citizens’ Advice Bureau.