Citizens Advice: Good news for credit card users

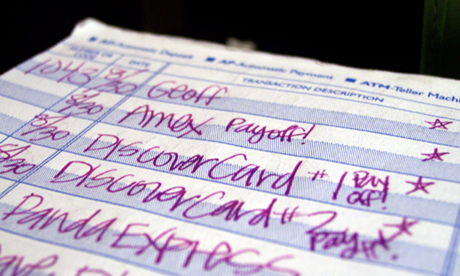

Changes have been introduced regarding how credit card companies can operate. Photograph: Lemon Jenny

Citizens Advice has been campaigning for changes to the way that some credit card companies operate, so we are delighted at the recently announced changes to credit card users’ rights.

Last year, bureaux nationally dealt with almost half a million enquiries from people worried about credit card, store and charge card debts. These changes will improve transparency and help people to manage their credit card repayments.

The six changes are:

1) The most expensive debt will always be paid off first. Before, most credit card companies would use your repayments to pay off your cheapest debt first, leaving your more expensive debt, such as cash withdrawals, languishing unpaid at a higher interest rate.

2) On new accounts, making the minimum payment will still reduce the outstanding balance. With new accounts opened from 1 April 2011, credit card companies must set the minimum payment at a rate that reduces your actual balance by at least 1% each month. Previous practices allowed for minimum payments which would often only cover fees and interest charges without reducing your overall outstanding balance.

3) Credit card cheques will only be sent out on request.

4) More choice and control over credit limit increases. Before, credit card companies could increase your credit limit without asking you. Now, they have to contact you if they want to increase your credit limit, and you will have 30 days to decline the increase.

5) Clearer communications about interest rate increases. Now, if your credit card company contacts you with an increase in your interest rate, you will have 60 days to decide whether to reject the new rate, giving you time to shop around for better deals.

6) More flexibility about how much you pay towards your bill. Previously, you normally would have to pay either the outstanding balance or the minimum payment each month if you wanted to set up a regular payment. Now you can choose to repay any amount you want between the minimum and the full balance.

We hope that these changes will give credit card users more flexibility and control over their accounts. If you are experiencing difficulties with your credit card debts, don’t panic – remember to prioritise your payments on priority debts such as your rent or mortgage and council tax and seek advice early on.

You can get help and confidential advice at Hackney Citizens Advice Bureau, 236 – 238 Mare Street E8 1HE. Tel: 020 8525 6350.

Hackney CAB is one of four bureaux managed by East End Citizens Advice.